Experts see inflation, interest hikes causes of banking crisis

Xinhua

18 Mar 2023, 01:14 GMT+10

Analysts said a major factor contributing to the troubles was rising interest rates, as central banks labored to rein in inflation.

ROME, March 16 (Xinhua) -- With central banks' efforts to combat soaring inflation over the last year seen as having a major role in recent troubles for the European banking system, analysts say new adjustments to policy could have a knock-on effect slowing economic growth and lengthening current inflationary trends.

Within days of the failure of two United States banks -- Silicon Valley Bank (SVB) from California and New York's Signature Bank -- worries about its impact on European financial institutions began to push share prices downward. Led by banking shares, most European stock exchanges suffered significant losses on Monday and Wednesday, each time followed by only modest rebounds.

The biggest European victim so far was Credit Suisse, the Swiss banking giant. The company's shares lost almost a fourth of their value on Wednesday.

Analysts said a major factor contributing to the troubles was rising interest rates, as central banks labored to rein in inflation sparked by the conflict between Russia and Ukraine. In 2022, prices in the eurozone rose by an average of 8.4 percent, the highest rate recorded since the introduction of the euro currency in 1999.

"Both the Fed (U.S. Federal Reserve) and the ECB (European Central Bank) underestimated the resurgence of inflation," Giorgio Di Giorgio, a professor of macroeconomics and monetary policy at Rome's LUISS University, told Xinhua.

"They started to react to the increase of inflation above the 2-percent objective with six or eight months of delay, and they were not the only ones," Di Giorgio said, adding that when the central banks reacted to rising prices, they did so aggressively by raising interest rates.

"Clearly, when you do something like this, and you keep doing it for a year, as the Fed has been doing for eight months, and as the ECB has been doing, you are putting a weight on the shoulders of those who hold debt."

That was the case for the banks hit hardest, be they the U.S.-based banks or Credit Suisse and other European institutions, said Di Giorgio.

Sandro Sandri, professor of corporate finance at the University of Bologna, said that regardless of the reasons behind the recent bank difficulties, the impact of the crisis will be widespread.

"I think we're seeing the result of arrogance on the part of financial markets," Sandri told Xinhua. "Now economies will pay the price."

Sandri said he believed economies would suffer from a slowdown in lending from financial institutions worried about liquidity, especially in the high-tech sector. He also predicted higher yields on government bonds, all combined to result in slower economic growth.

"This is all happening very, very quickly, showing us how quickly news can travel and impact markets," said Sandri.

Both Di Giorgio and Sandri said that recent events would force central banks to reevaluate their strategy of battling inflation through increasing interest rates, though neither predicted it would be reversed in the short term.

"I think we're going to see central banks slow down the pace at which they raise interest rates," said Di Giorgio. "They will continue to do it, but they will do it more gradually."

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of China National News news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to China National News.

More InformationBusiness

SectionUBS CEO Ermotti to earn $17 million in 2024, report says

FRANKFURT, Germany: UBS CEO Sergio Ermotti will receive a pay package of just over 15 million Swiss francs (US$17 million) for 2024,...

France calls for talks as EU bourbon tariffs backfire

PARIS, France: French Prime Minister Francois Bayrou acknowledged over the weekend that the European Union may have miscalculated by...

U.S. stock markets slide, Dow Jones drops 260 points

NEW YORK, New York - Sellers took charge again on Wall Street Tuesday as the brief rebound that took place on Monday petered out. Stocks...

Expansion of Montana coal mine approved by US

WASHINGTON, D.C.: The Trump administration has approved a plan to expand a coal mine in Montana and keep it running for 16 more years,...

Tampa Bay Rays pull out of ballpark project over costs, delays

ST. PETERSBURG, Florida: The Tampa Bay Rays have decided not to move forward with a $1.3 billion plan to build a new stadium next to...

Vietnam, US sign energy and minerals deals amid trade talks

HANOI, Vietnam: As Vietnam seeks to strengthen trade ties and avoid potential U.S. tariffs, companies from both countries signed agreements...

Asia Pacific

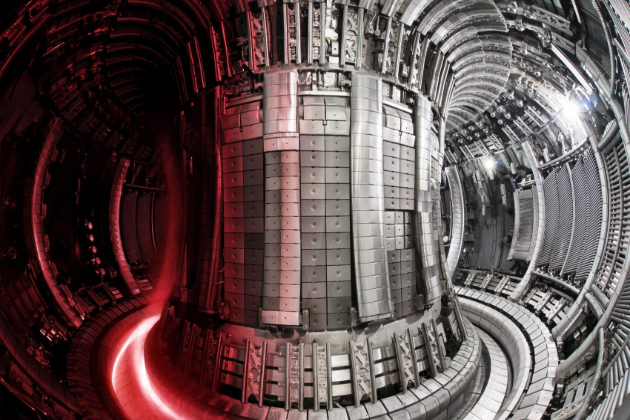

SectionVirginia governor warns US must fast-track fusion or fall behind China

NEW YORK CITY, New York: The U.S. must accelerate its efforts to develop fusion energy or risk losing its edge to China, Virginia Governor...

China now dominates shipbuilding; US faces security risks

WASHINGTON, D.C.: In the past 20 years, China has become the world's top shipbuilder, producing more than half of all commercial ships....

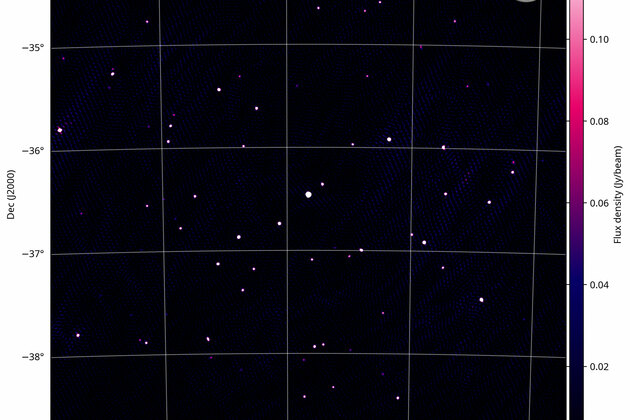

AUSTRALIA-CANBERRA-SKA-LOW-IMAGE

(250319) -- CANBERRA, March 19, 2025 (Xinhua) -- This is the first image from SKA-Low, Australia's groundbreaking telescope, released...

(SP)SOUTH KOREA-SEOUL-FOOTBALL-FIFA WORLD CUP QUALIFIER-PRESS CONFERENCE

(250319) -- SEOUL, March 19, 2025 (Xinhua) -- Son Heung-min, captain of South Korea, attends a press conference before the FIFA World...

ITALY-MILAN-CHINA-CISCE-PROMOTION

(250319) -- MILAN, March 19, 2025 (Xinhua) -- Guests attend a roadshow of the third China International Supply Chain Expo (CISCE) in...

VietJet launches direct flights between Hyderabad and Ho Chi Minh City

Hyderabad (Telangana) [India], March 19 (ANI): Hyderabad and Ho Chi Minh will now be directly connected via VietJet flight, reducing...